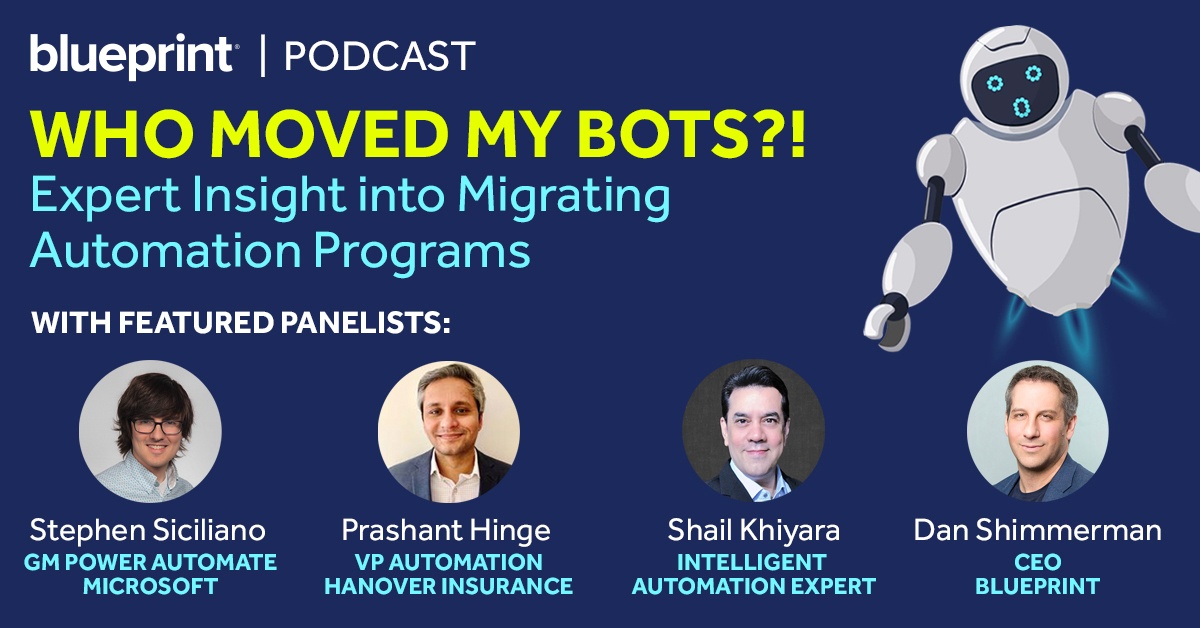

5 Takeaways From Our Recent RPA Migration Panel: Who Moved My Bots?

On Tuesday, December 7th, Blueprint gathered automation leaders from around the world to share their invaluable insights on all things RPA.

The panelists included:

- Stephen Siciliano - GM Power Automate at Microsoft

- Prashant Hinge - VP Automation at Hanover Insurance

- Shail Khiyara - Intelligent Automation Executive

- Dan Shimmerman - CEO at Blueprint Software Systems

The discussion focused primarily on how customer needs aren’t being met in an intelligent automation market that is increasingly dynamic and consolidating—creating opportunities for RPA programs to migrate their automation portfolios to new tools. From there, the panelists explored the benefits of migration, how to measure the success of a migration program, and best practices to follow when switching vendors.

Below we’ve captured five key takeaways from the discussion, and, if you’re interested, the full recording can be accessed here.

1. New Features, Capabilities are Major Drivers of Migrations to Newer Versions of RPA Tools, but Downtime, Compatibility, and Viability are Still Concerns

There’s currently a lot of movement in the automation ecosystem as RPA programs are migrating their portfolios of digital workers from one RPA tool to another.

When discussing what’s motivating these RPA platform migrations, Shail Khiyara pointed to evolving features and capabilities of the different RPA platforms as the key motivators encouraging automation leaders to switch platforms–either to a newer version of their RPA tool or another RPA platform altogether. Yet downtime, fragile bots, and compatibility issues are still barriers that arouse concerns and inhibit all-out switches

“Over 50% of the roughly 30,000 customers in automation today are using legacy versions of automation (i.e. past versions) primarily because their systems, their infrastructure, and most importantly, the success of their automation is tied to those versions. In doing so, they're not able to take advantage of the new features and functionality available on newer versions; bot fragility, downtime, backward compatibility, integration, viability are all authentic business concerns when it comes to migration from one version to another; let alone to another vendor.”

In response to those concerns, Dan Shimmerman explains that’s exactly what Blueprint’s RPA Platform Migration solution addresses and solves for,

“We at the company (Blueprint) have invested considerable amounts of time, energy, and capital, into building something we call a Common Object Model, which is a standard universal automation language. It's agnostic to RPA platforms. It identifies and maps all the commands, actions, and parameters across platforms. And it's really what facilitates the ease with which these migrations can occur through the technology. The value is massive time and cost savings; 75-80%. The higher quality automations and the output is really what drives the value of being able to keep these up, being able to take on more complexity in these automations, is where customers are getting a ton of value.”

2. RPA Platform Migration is a Kickstarter to Legacy Modernization

When illustrating some of the main factors motivating migrations onto the Microsoft Power Automate platform, Stephen Siciliano indicated that customers are looking for a single offering and platform that can automate what's happening in modern services and what's happening on-premises as an entry point to migrating from legacy systems to the cloud.

“When we think about migration…there's an even broader migration story of modernizing the systems that are inside of organizations. […] moving to an intelligent automation platform is just a great way to start that process and to kick it off in a relatively painless manner. So that's what excites a lot of the customers that we've been talking to.”

3. Design Time, Development Time, Uptime, TCO, and Reusability are Key Metrics in Any RPA Platform Migration

There are numerous reasons to migrate RPA platforms, but how do you know if switching is a success? What do you measure?

Prashant Hinge, VP Automation at Hanover Insurance, explained that there’s a few different metrics and KPIs to track after migrating RPA tools,

“We have a certain set of criteria around development time, design time, and uptime for these automations. So, at best, it should remain the same or better than what we are providing. […] Now there is another bucket (of metrics), which I would think of as the main drivers for us to leverage newer tools and technologies or even migrate and look at parameters. Are we seeing a downward trend in the total cost of ownership year on year? I think it should not remain flat; we should see a downward trend.

Second, what is the reusability component of building in one place, and then taking it to different places? Because now that we are moving, we are hoping we can expand the scope of the migration, so we measure that.

And then the third piece is around data insights. In an RPA-only world, you look at operating at the task level, but in this, hopefully new world, you're looking at end-to-end processes. So now, all the data that you get, what can you do with those data points? Can you apply other machine learning algorithms to come up with some trends and analyses and insights that you can share with the business stakeholders? And so on, and so forth, so that way, it's easy for them to manage and operate on a day-to-day basis.”

4. In Some Cases, A Multi-RPA Platform World Makes Sense

RPA platform migrations aren’t always about consolidating automation portfolios in one centralized RPA tool. In some cases, organizations are happy living in a multi-RPA platform world and instead wish to migrate only certain use cases that make sense, as Stephen Siciliano explains,

“We do actually see a number of customers who live in a multi-vendor world where they have some use cases that they migrate, that makes sense, but they leave other use cases on their existing tooling for whatever reason. So, we do see a little bit of a mix there, and I think in many cases, it depends on different departments that want to take different approaches. One department may want to move, another department may not want to move, but we think, at least from my perspective, we do see kind of both approaches happening inside of organizations.”

5. Large Enterprises in Highly Regulated Industries are Driving Migration

Even though interest in RPA platform migration spans across industries, those leading the charge tend to be large enterprises in highly regulated industries, Blueprint’s CEO, Dan Shimmerman explains,

“…we definitely see a lot of interest coming from very large enterprises, in highly-regulated industries. I think we've talked a lot about legacy systems and some of the technologies really struggling to keep up with the more modern direction of Intelligent Automation platforms today like Microsoft. And so, one of the problems inherent in these legacy systems is a failure to identify requisite enterprise dependencies that constrict and constrain how work gets done. Business rules, regulatory constraints, internal controls, and as these change, it impacts how work is done. Now you layer in automation, it's a real nightmare. And so, we're seeing a ton of interest in migrating to modern platforms that can address some of these needs, and this is where we really help. So, we are seeing from an industry vantage, big banks, big health care providers, big telcos, any highly regulated industry, having much more of an appetite and a pain point around these migration initiatives.”

For the full recording of the panel discussion and all the valuable insight, experience, and expertise that was shared, you can access the recording here and share it with your whole team!

Share this

Recent Stories

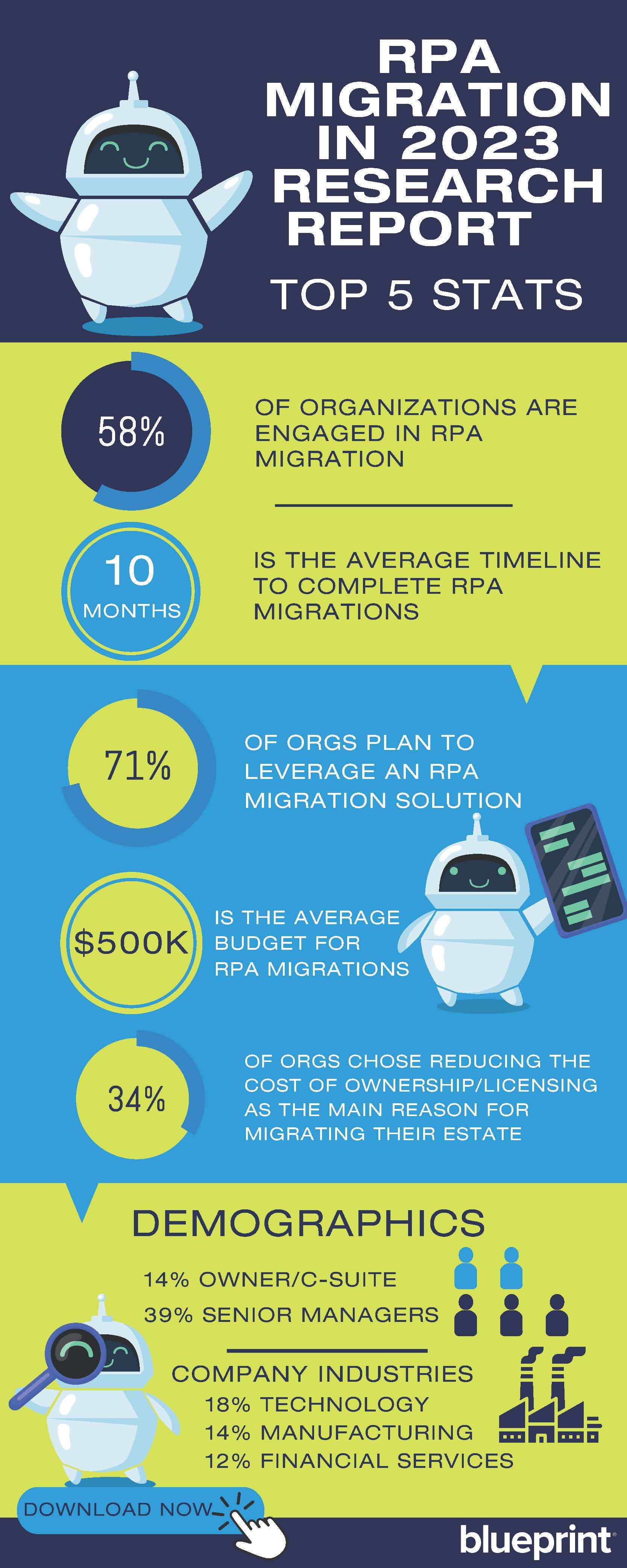

RPA Platform Migration a Top Initiative for Organizations This Year, According to Research by Blueprint Software Systems

The Hidden Value of RPA Migration: Cost Savings and Scalability