Everyone’s eye is on the financial services industry – it’s an extremely competitive field filled with newsworthy risks and rewards. Investment firms, banks, insurance companies and other financial institutions operate knowing that even the smallest error can cost their firms millions of dollars and compromise their reputations when these missteps make international headlines.

Many financial institutions have dated infrastructures that struggle to develop new payment processing systems, financial accounting systems, asset and risk management systems, as well as digital and online banking services. Moving forward, financial services firms need a sophisticated, flexible infrastructure and methodology to ensure the proper management and successful, timely delivery of their IT projects.

What is the best way for financial firms to build upon their success while reducing their risk?

Effective IT solutions require a comprehensive understanding of this industry’s priorities, best practices, competitive landscape, technology networks and customer services.

Financial services firms have long relied on Waterfall-oriented approaches, but today’s market is demanding change. The transition to Agile is well underway and brings new principles and practices into long familiar development methodologies.

(Water)Fall into the Same Trap?

The Waterfall model has long been the standard approach for financial services developers – Waterfall’s fixed deliverables and well-defined phases appeal to companies that prioritize predictability and limited risk.

Waterfall has helped organizations deliver many successful finance projects, but its relative inflexibility means more stringent requirements and longer delivery times. These deterrents can add additional time to an already lengthy project and can delay revenue streams if a competitor goes to market faster with a similar technology. With a need for speed to stay competitive, financial organizations are re-evaluating their current IT approach and exploring the possibilities of becoming Agile.

Adopting an Agile Approach

Agile offers the flexibility and responsiveness that Waterfall tends to lack. With its own manifesto and a growing number of enthusiasts, Agile is the software equivalent of lean manufacturing.

In comparison to Waterfall’s rigid steps, Agile emphasizes flexibility through adaptive planning, continuous improvement, early project delivery and increased communication between team members as some of its key components.

A less rule-heavy method, Agile promises faster time-to-market, improved business agility, and a better response to changing environments; but employing Agile is not a singular approach and its introduction can disrupt an organization.

Yes, Agile principles have the potential to drive faster, more innovative solutions, but adopting Agile can’t be done overnight. There is a transition period and smart companies focus as much on the transition process as they do the development project.

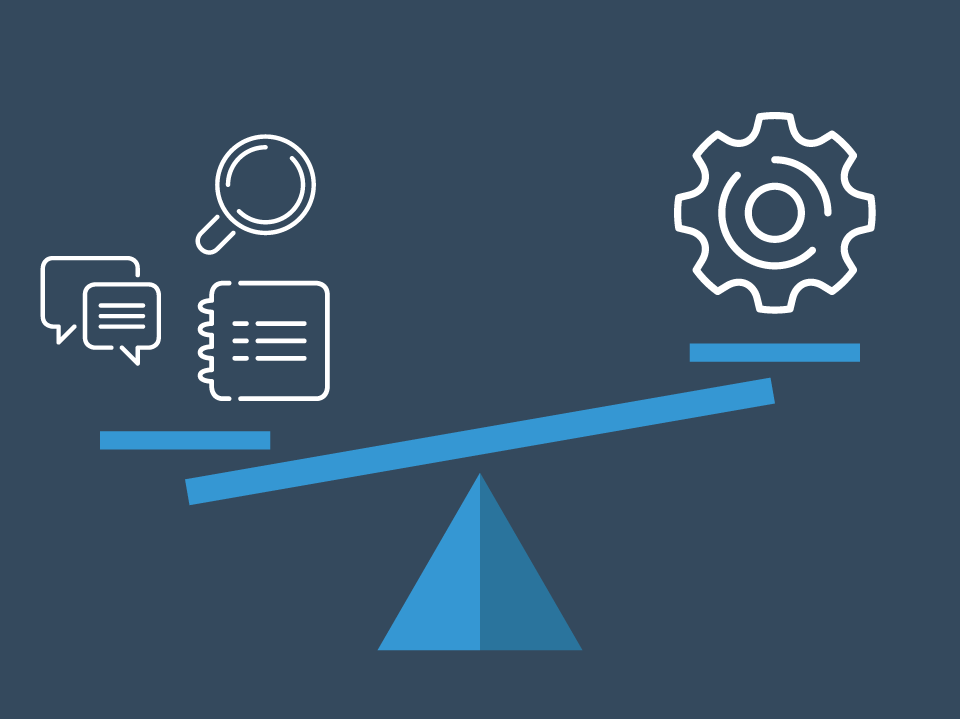

Hybrid – Meeting in the Middle

An increasing number of companies are incorporating Agile principles into their projects while continuing to use Waterfall. Transitioning to Agile is a gradual process – many Agile practices are being adopted slowly and integrated alongside traditional Waterfall methodologies.

This Hybrid model takes the best of both Waterfall and Agile, creating a best-of-breed approach for companies striving to leverage process models that deliver successful business outcomes and add value to their customer and stakeholder experiences.

There are obvious benefits to implementing a blended approach but, similar to Agile, it’s not a simple execution and may intimidate some as they transition into this model.

Which Approach is Best for Us?

With a new focus on cybersecurity for 2015, according to Deloitte’s 2015 Financial Services Outlook, financial services CIOs will be seeking a Waterfall Agile Hybrid approach to their IT solutions. When introduced successfully, adding Agile principles to an established Waterfall methodology can result in innovative, competitive benefits.

But a transition of this scale cannot be accomplished alone.

You need someone who understands the IT needs of the financial services industry, the benefits and challenges of adopting Agile, Waterfall and a blend of the two, and can guide you through the changing landscape of software development.