RPA in Insurance and Compliance Industry Applications

The biggest use case for RPA in insurance, by far, is automating claims processing to improve its quality, speed, and availability. However, another critical RPA use case in insurance quickly gaining momentum is automating compliance activities.

For far too long, compliance teams in insurance companies have struggled with executing day-to-day activities because reactive issues take up too much of their time—time that could be used toward developing forward-looking risk mitigation.In a study conducted by Thomson Reuters, one-third of the firms surveyed said they would spend at least an entire day each week keeping track of the changing regulations. In addition, 69% of respondents said they expect regulators to propose additional rules in the coming year. The industry study also revealed that the lack of coordination between internal functions causes firms to miss opportunities to leverage resources.

The speed and sheer breadth of regulatory change remain a constant challenge for firms. As business needs evolve, becoming more complex, it becomes even more difficult for compliance teams to keep up. The compliance function must change its focus from reactive to proactive to mitigate further risks. RPA in insurance and automating compliance activities will impact how the function is governed, the tools, technology, and analytics it uses; and how it connects with other parts of the business.

Consider the following key forces that are driving the application of RPA in insurance and compliance industry handling:

- Regulators are strengthening and increasing their control overall within the industry

- Customers are looking for products that have new features and innovative services

- Shareholders are searching for low-risk investments with stable returns to protect their capital

- Technology is reshaping the business model but exposes the company to new risks

The demands on businesses and compliance programs are more complex than ever, so doing nothing is no longer an option. Teams must invest in technology, improve processes, and deliberately focus on what the business, risk, and operation functions can contribute to the development of more predictive insights.

Drivers for RPA in Insurance and Compliance

The pressure to make a change and introduce robotic process automation in insurance compliance models comes from many directions, including:

- Internal Challenges can include ineffective coordination across multiple business units, a lack of compliance strategic vision, and/or ineffective use of technology.

- Emerging Technologies can include regulatory technology such as cognitive compliance, governance, risk analysis, and/or big data analytics such as predictive analytics, and the increased use of high-volume data to drive risk identification and process enhancement.

- Regulatory Pressure can include new regulatory requirements, increased regulatory examinations and inspections, increased enforcement actions, fines, penalties, and/or heightened standards and expectations.

Attributes of a Modernized Compliance Program Using RPA in Insurance

The aim of any basic automated compliance program will always be to mitigate risk and comply with the numerous regulations that are specific to your line of business. A modern compliance program that leverages RPA goes beyond the basic objectives and works with new technologies, tools, and practices to generate measurable value for the compliance function.

Regulatory compliance leveraging RPA in insurance can be used for any of the following:

- Data security modernization

- Compliance auditing

- Compliance reporting

- Client information screening

The goals of automating compliance activities as a use case for RPA in insurance should include:

- Being proactive instead of reactive: Compliance is an ongoing process, so testing and monitoring are critical – don’t waste time doing it manually, automate it. Implementing RPA in insurance and automating your processes will save you time and resources, enabling you to focus on other areas such as developing forward-looking risk management practices.

- Align Compliance Risk Management strategy & business strategy: Compliance is a company-wide objective; the Compliance Risk Management strategy should be embedded across all business functions to drive value and provide greater insight into its effectiveness.

- Enhanced regulatory change management coverage and processes: By leveraging artificial intelligence (AI) and natural language processing (NLP), compliance teams reduce time spent keeping up with changing regulations by monitoring global authoritative services for relevant content and automatically updating a repository of current regulatory content.

Outcomes of a Modernized Compliance Program Using RPA in Insurance

Implementing RPA in insurance helps compliance teams in various key ways. Here are 8 Outcomes of a Modernized Compliance Program that leverages automation:

- The execution of automated processes removes human intervention and is less prone to error, mitigating the risk of non-compliance.

- Connecting automated processes to specific regulations and controls produces an instantly accessible audit trail that facilitates regulatory scrutiny and facilitates easier and more effective change management when regulatory changes are introduced.

- Transformative Change: Core processes are re-evaluated and automated to be more proactive and predictive.

- Flexibility: Modern compliance programs using automation can rapidly scale up or down and ready to respond to any changes to the business or regulatory landscape.

- Increase to Capacity: Through the use of RPA in insurance and upgraded tools, teams will be able to take on more without compromising the quality of work.

- New Competencies: Compliance professionals can connect to new business partners and advisors.

- Cost Reduction: Cost reduction opportunities exist through the use of RPA in insurance, technology, and resource allocation to effectively manage the increased capacity of work.

- An enterprise-wide view of risk and compliance: Working in tandem across all business units to ensure compliance.

Blueprint’s Enterprise Automation Suite provides compliance teams in insurance organizations with the modernization tools to transform their compliance programs from reactive to proactive. Blueprint’s Impact Explorer – a core tool in the Enterprise Automation Suite – delivers end-to-end risk analysis so compliance officers can instantly see what’s impacted whenever a regulatory change is introduced. It also provides invaluable mechanisms to coordinate the proactive actions needed to minimize risk and facilitate seamless change management.

Watch the short demo video below to see how you can leverage RPA in insurance and modernize your compliance program:

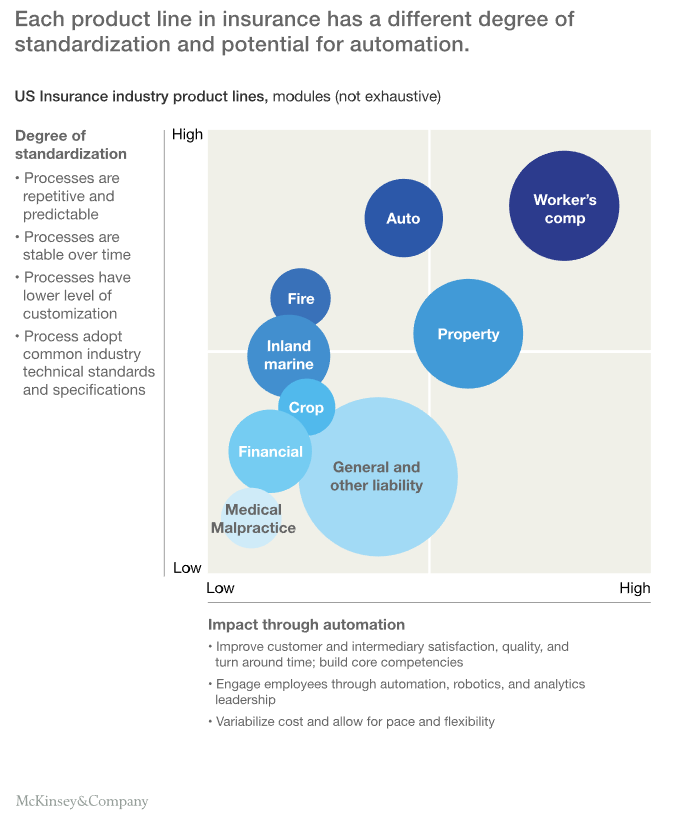

Image source: Mckinsey Digital, Intelligent process automation: The engine at the core of the next-generation operating model. By Federico Berruti, Graeme Nixon, Giambattista Taglioni, and Rob Whiteman, March 14, 2017.

Share this

Recent Stories

When Does It Make Sense to Use AI Agents in Enterprise Automation?

Governance for AI Agents: How to Keep Autonomy from Becoming Anarchy