5 Ways Automation and RPA are Changing Financial Services

The financial services industry's early adoption of Robotic Process Automation (RPA) means they are among the most mature industries on the automation journey. Having adopted RPA early on, they've allowed it to change financial services for the better, and are constantly looking for ways to improve their automation efforts—even if it means switching RPA platforms for greater value capture. Today, they continue to foster automation, upping the ante with each innovative iteration.

Beginning with robotic process automation, now the financial services industry wants to capitalize on the next wave of automation enhancements; intelligent automation. In particular, how RPA that leverages Artificial Intelligence can continue to transform their operations with greater efficiency, more cost reduction, and better customer experiences.

Looking at the present with an eye on the future, here is how automation and RPA are changing Financial Services today and for tomorrow:

1. Unlocking Resources to Perform More Value-Added Activities

RPA and automation are changing financial services by liberating employees from mundane, repetitive tasks to concentrate on more value-added activities. RPA is a proven solution to take over the rules-based, swivel-chair tasks that used to occupy professionals while performing those same processes quicker and with higher-quality output by removing the risk of human error.

With employees having their hands freed from the chains of routine, mechanical processes, they can devote that time to fostering innovation, providing analytical insight, and leveraging their critical thinking skills to drive key business objectives forward.

2. Improved Fraud Detection

As organizations within the financial services industry actively embrace automation and are the most mature in its application, it's no surprise that they're also pioneers in investigating and adopting intelligent automation. Intelligent automation essentially combines RPA with artificial intelligence—like machine learning and natural language processing —to automate more processes end-to-end, instead of only a portion of them.

Financial services companies are actively using machine learning technology and automation to strengthen fraud detection, quality, and accuracy. One example from Deloitte is the use of machine learning alongside databases that include the date, time, merchants, prices, etc., from credit card transactions to better predict when fraudulent transactions are made.

3. Automated Security

According to Verizon's 2020 Data Breach Investigations Report, 1,509 security incidents were identified in Financial Services alone with 448 confirmed data disclosures. 63% of these attacks were motivated by external perpetrators looking for monetized data, and 9% resulted from human error.

The direct threat externally and the unintentional threat internally is significant and real. RPA in financial services is largely being applied to mitigate this threat. Specifically, automation is being used to strengthen data security and defend against the growing frequency of cyber-attacks and internal errors, leading to vulnerabilities.

Some concrete examples where RPA is already being applied to strengthen cyber-security for financial services include automating event management and reporting automated health checks and vulnerability testing, and security patch management.

4. Faster Customer Onboarding

One of RPA and automation's main objectives, not just in financial services but across industries in general, is improving the customer experience.

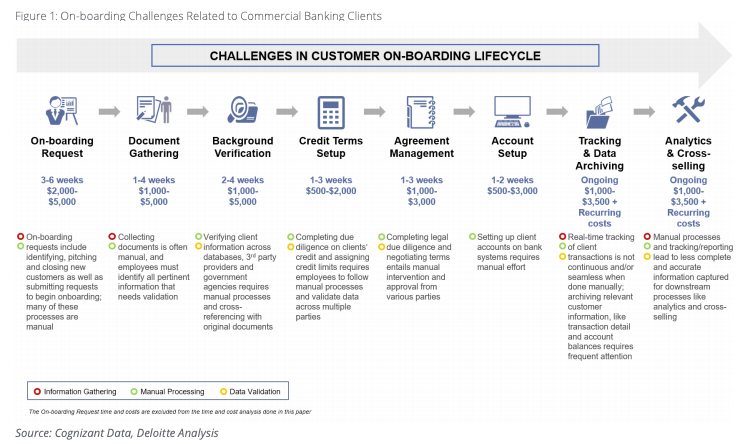

The customer onboarding lifecycle has historically always been a challenge for large organizations in financial services. This is because a compliant and secure onboarding performed with due diligence demands significant time, manual effort, and resources. According to a study conducted by Deloitte, onboarding new customers for commercial banking clients takes between 20-90 days and incurs a maximum of $25,000 of revenue lost because of delays. In the same study, 89% of respondents claimed to have poor onboarding experiences with their financial institutions.

To address this and reverse the trend of lost revenue, financial services have jumped headfirst to automate and transform the client onboarding life cycle to improve risk analysis and execution speed. Common onboarding processes automated with RPA include a range of both front office and back office tasks like KYC (know your customer) processes, customer information verification, legal and background checks for risk analysis, and both agreement and contract management.

5. Improved Compliance Handling

In financial services, big teams and a massive manual effort are devoted to compliance activities. Yet, many organizations in this space have quickly realized that these activities can be significantly reduced while enhancing compliance quality and accuracy.

Major compliance operations are already rapidly being automated, like customer due diligence, trade surveillance, risk analysis, variance tracking, and compliance audit analysis. These automations have not only enhanced the output of these processes by removing the introduction of human error; they've also made them quicker and more accurate.

However, regulations are also constantly evolving, producing new controls and policies that financial services must abide by to avoid penalties. This, unfortunately, not only complicates the life of compliance teams, but it also makes RPA and automation in financial services more complex, as each change that's introduced must be cross-referenced with all bots in production to identify what's impacted and where.

This is an area where Blueprint's Enterprise Automation Suite excels, unlike any other solution on the market. As the most powerful automation design environment available that sits in the middle of your automation toolchain, Blueprint's Impact Explorer – a core tool in the Enterprise Automation Suite – delivers the ability to visualize change instantly. By connecting your automated processes to all dependencies like regulations, any time a change is introduced, you can instantly zero in on which automated processes are impacted and coordinate the proactive actions needed right from the Impact Explorer.

In the effort to improve change management for increased RPA uptime and business value delivered, countless organizations are consolidating their automation efforts in Blueprint and eliminating automation silos. One way they're doing this is by migrating all digital workforces across disconnected RPA vendors into one RPA platform for greater efficiency, delivery, and cost savings.

Financial services organizations are also using Blueprint's unmatched migration capability to switch to RPA platforms that promise a faster time to scale and greater ROI. One common demand that can be seen in the market is the desire to switch to Microsoft's Power Platform that promises Intelligent Automation at scale, greater cost savings, and allows organizations to leverage the extensibility of Microsoft's suite of products.

Learn more on how Blueprint is enabling countless financial services organizations to consolidate their digital workforces or switch RPA providers entirely at 25% of the cost and 3x as fast.

Share this

Recent Stories

Intelligent Automation Solutions for Enterprise Processes

3 Overlooked Ways RPA Can Help Drive Your Digital Transformation